Tax Strategies for the Commercial RE Professional

Event Time:

9:00 am – 12:00 pm

3 CE Hours

$65.00 WSCAR Members | $75.00 Non-Members

Location:

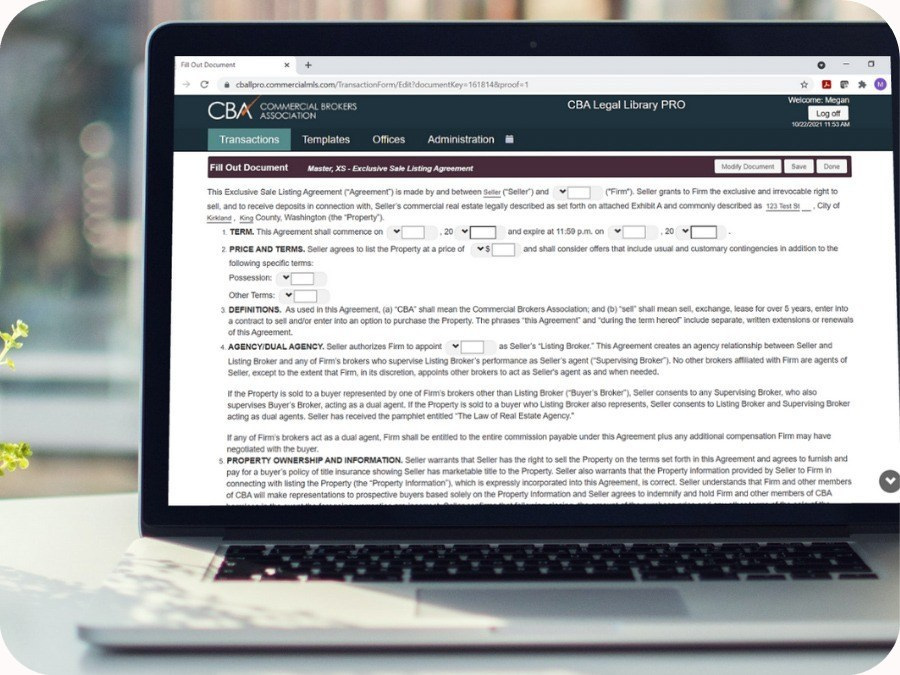

CBA Training Room

12131 113th Ave NE, Suite 101

Kirkland, WA 98034

If your accountant could follow you around every day and record everything you do, you’d be in great shape. Since that's impossible, you have to know what you can and cannot deduct. Tax Strategies for the CRE Professionalfocuses on the daily tax reduction possibilities for *any self-employed professional. Topics covered include:

- Vehicle and mileage deductions

- Dutch-treat rules that allow you to ask for referrals and prospect while playing golf, going to the movies, or attending other social and sporting events

- Plus, how learning new business skills from each other can be deducted for a trip to the movies, the golf course, or any other fun activity

- Record keeping instruction helps get you more organized and save hundreds of hours a year

- Plus, how keeping the right records in the right way can open-up a whole new world of tax deductions

Join us and learn how to find and document thousands of dollars in new deductions.

*Designed for the One Owner or Husband Wife Owned business such as 1099, Statutory Employees, S Corps, LLCs and Proprietors. Not for Common Law, W-2 Employees.

Instructor:

Maine Schafer, J.D, Bradford and Company

Click here to Register Online or contact CBA at 800.275.2522 or email register@commercialmls.com for assistance.