CBA SALES OVERVIEW &

FULL RESEARCH REPORT

CBA Commercial Property Sales

2023 End-of-Year Report

Washington's Commercial Property Sales Market Reached Its Floor in 2023 with the Lowest Annual Sales Levels Since the Great Recession

CBA's Commercial Market Analysis (CMA) Sales Report analyzes yearly and quarterly economic and commercial real estate sales activity and trends at the market and submarket levels. We are pleased to offer this detailed analysis and report for your use and interpretation.

In this report, we compare annual, quarterly and year-to-date numbers by asset class from Washington’s six largest counties from 2022 through 2023.

Summary Highlights from Q4 & Full Year 2023:

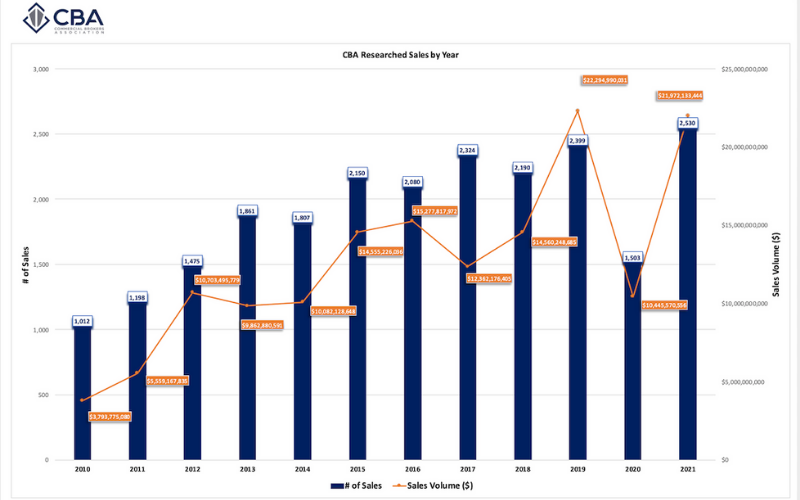

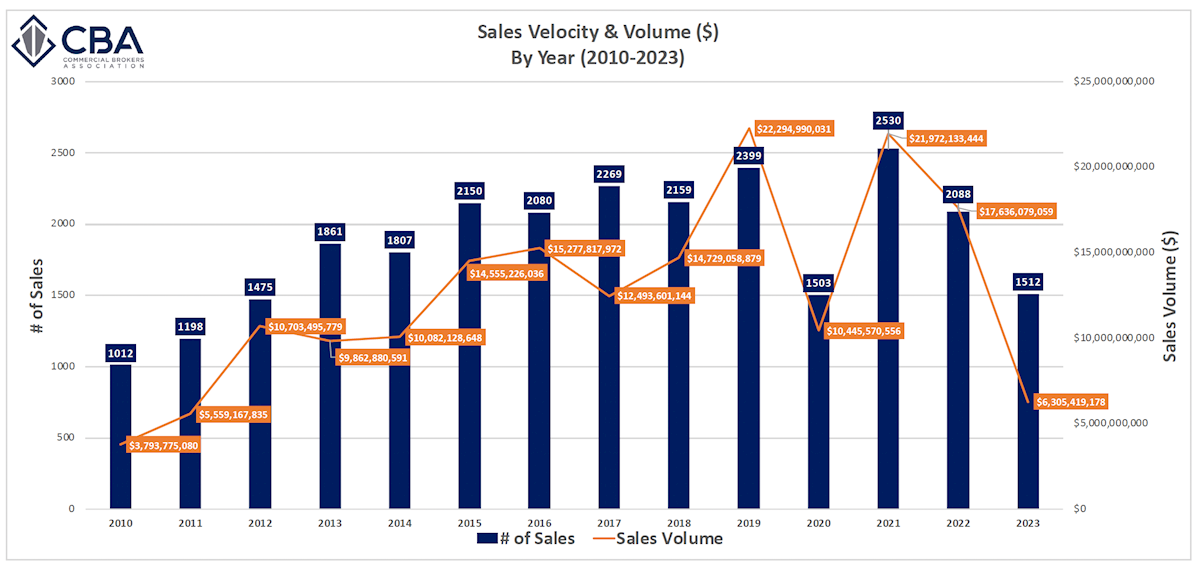

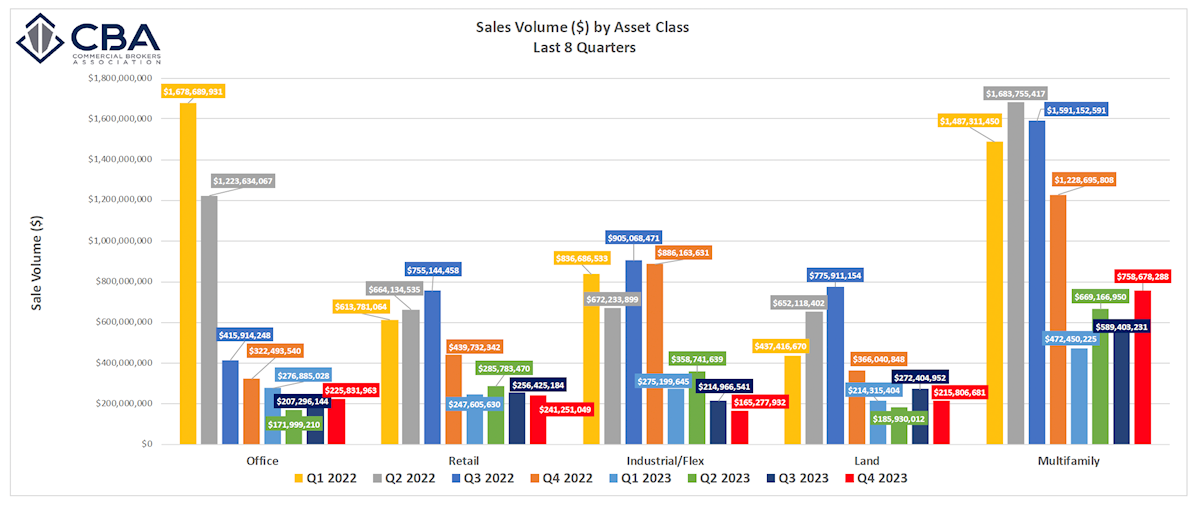

- At $6.31 billion, 2023 commercial property sales volumes reached their lowest levels since the Great Recession in 2011, which were $5.60 billion.

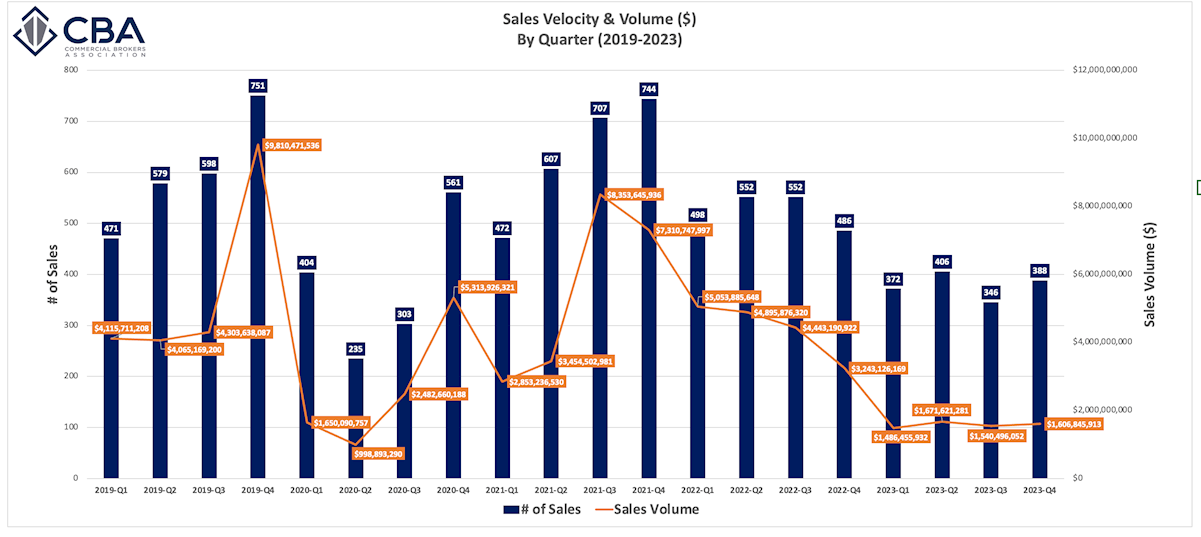

- Washington’s commercial property sales market reached its floor in 2023 and remained stable at current levels for the past year, with the last four quarters of sales volumes ranging from $1.5 billion to $1.7 billion.

- Private capital, non-institutional grade property sales drove market activity in 2023.

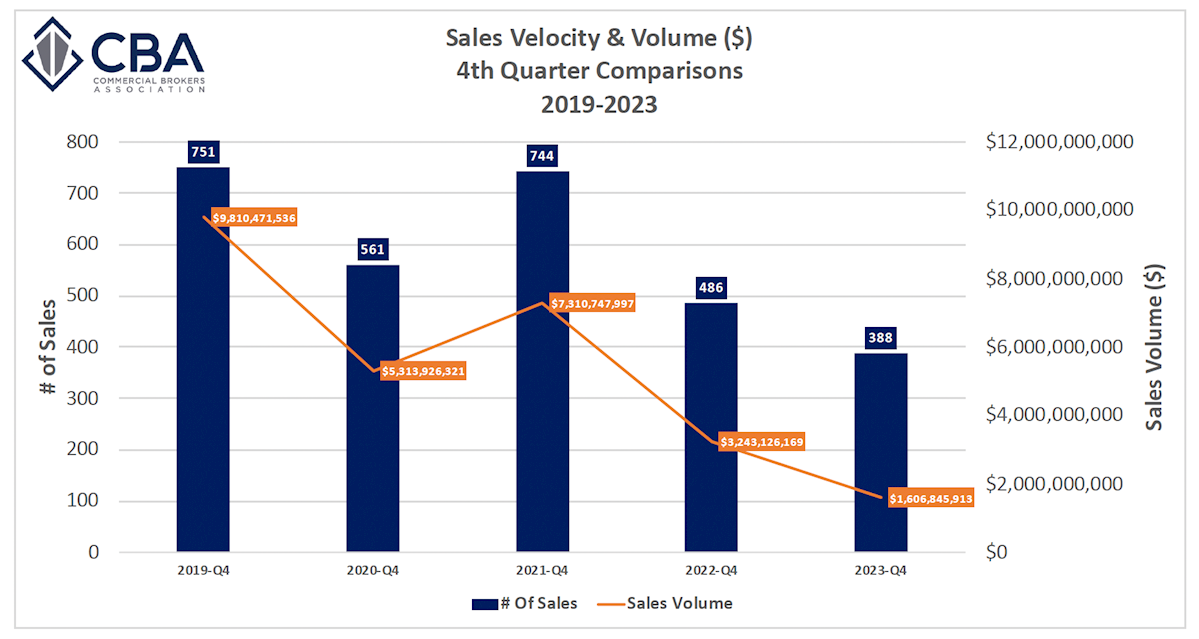

- While 2023’s full-year sales volume was down 64%, the rate of declines quarterly slowed modestly compared to prior year sales, with Q423 down 50.5% compared to 2022. However, much of the decline can be attributed to the effects of higher interest rates that were beginning to take hold in the second half of 2022.

- As interest rates have likely peaked for this cycle, the market is starting to see more institutional sales. While this is a positive signal of activity, and the market may see an uptick in 2024, a number of these sales are properties transacting below replacement cost or at reduced values paid compared to just 5 to 6 years ago. This suggests the likelihood of fundamental vacancy/cash flow issues or loan/financing challenges with the properties.

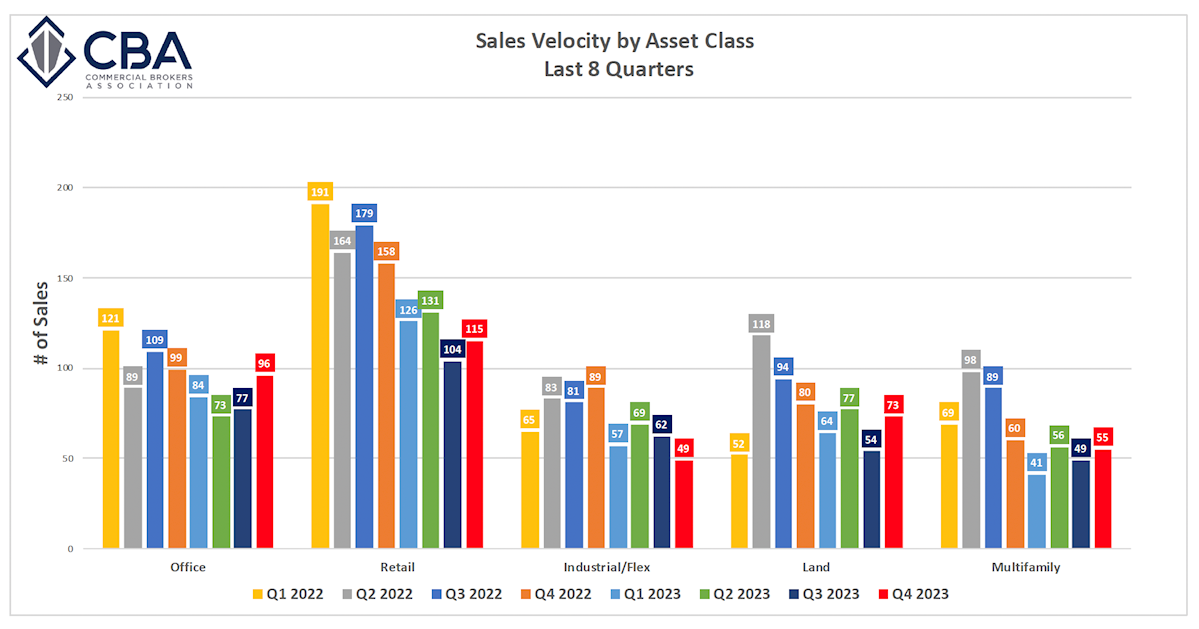

2023 Overall and 4th Quarter Sales

For 2023, CBA recorded and researched 1,512 transactions totaling $6.31 billion. This is comparatively the lowest number of transactions since 2020 (1,503 sales) and 2012 (1,475 sales). For sales volume, this is the lowest total since the $5.56 billion posted in 2011. Compared to 2022, it was a 28% drop in number of sales and a 64% drop in volume. Comparing Q4 2023 vs Q4 2022, sales velocity was down 20%, and volume was down 50%.

When ranking 2023 sales volumes by asset class and comparing to the prior year, Multifamily remained in the top spot, Retail moved up from 4th to 2nd, and Office dropped from 2nd to 5th.

Sales Volume Ranking for 2023 (with 2022 Rank in Parentheses):

- Multifamily - $2.49 billion (1)

- Retail - $1.03 billion (4)

- Industrial - $1.01 billion (3)

- Land - $888 million (5)

- Office - $882 million (2)

2023 vs 2022 Sales Velocity and Volume by County and Asset Class

County

- King: -23% in velocity, -51% in volume for Q4, -36% and -71% for 2023.

- Snohomish: -32% and -64% Q4, -24% and -61% 2023.

- Pierce: -11% and -22% Q4, -28% and -42% 2023.

- Spokane: -2% and -54% Q4, -7% and -20% 2023.

- Kitsap: -47% and -30% Q4, -19% and -19% 2023.

- Thurston: -7% and -49% in Q4, -14% and -29% 2023.

Asset Class

- Office: -3% in velocity, -30% in volume for Q4, -21% and -76% for 2023.

- Retail: -27% and -45% Q4, -31% and -58% 2023.

- Industrial/Flex: -45% and -81% Q4, -25% and -69% 2023.

- Land: -9% and -41% Q4, -22% and -60% 2023.

- Multifamily: -8% and -38% Q4, -36% and -58% 2023.

DOWNLOADABLE REPORTS

CBA researches office, retail, industrial, and land sales, $250,000 or more, in King, Snohomish, Pierce, Spokane, Kitsap, and Thurston counties. Multi-family sales of $250,000+, and 5-units+, are researched in King, Pierce, and Snohomish counties. All the raw data provided in our reports are pulled directly from the CBAcma database.

For questions about the report, please contact Binh Truong, Director of Market Data and Business Development, at binh@commercialmls.com or 425-952-2727.

ARCHIVED CBA SALES REPORTS

Reference previously archived CBA Sales Reports here: