Personalized Service,

Opportunities for All

Helping the Pacific Northwest Share Knowledge and Create Opportunity

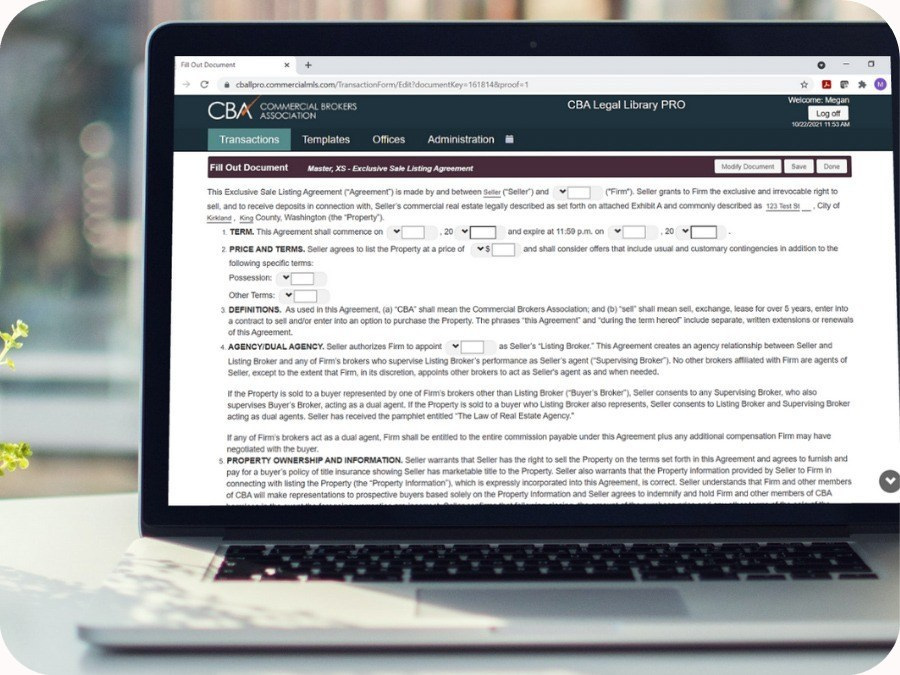

The Commercial Brokers Association (CBA) is a powerful association of commercial real estate brokers dedicated to developing the knowledge and skills of our members, increasing their success, and raising the standard of practice. Our member-owned cooperative provides market research, listings services, legal contracts, networking and education opportunities, association management services, industry lobbying, and arbitration to brokers and professionals in CRE-associated industries in the Pacific Northwest.

Join UsTrusted Tool and Services

We establish industry standards that all CRE professionals who join our organization agree to meet and deliver that shared information with powerful tools and unmatched personalized service

Become a Member and Build Opportunity

Our membership includes the top commercial real estate influencers and companies throughout the Pacific Northwest and Idaho.

Brokers

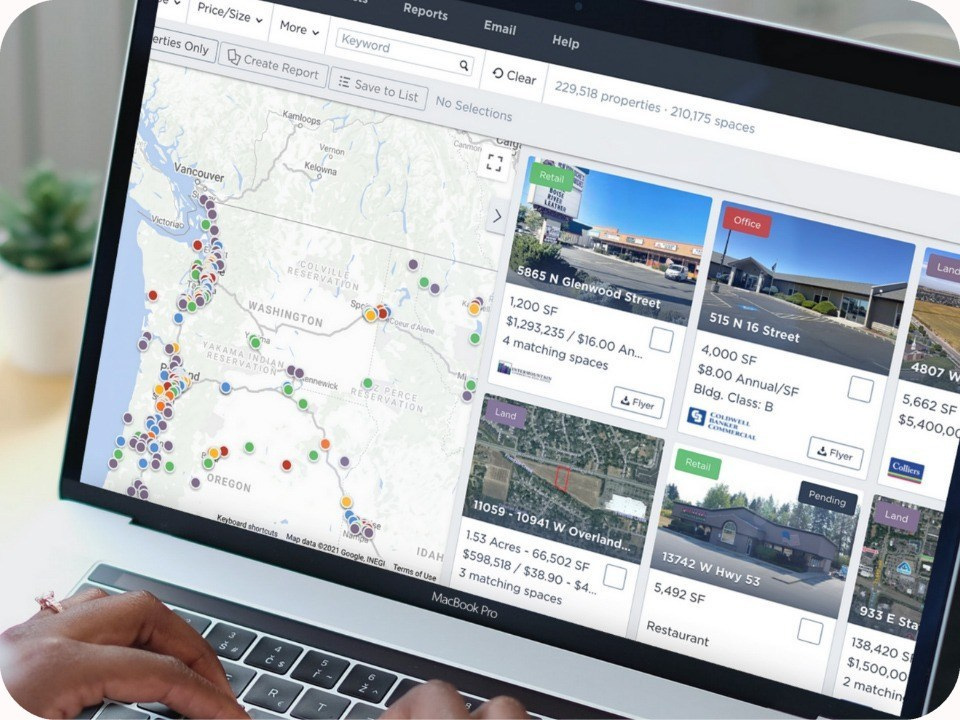

Get accurate, verified listings data and the tools you need to research properties, advise your clients, execute contracts, and get deals done -- as well as a clear path to cooperating compensation.

Brokerage Firms

Give all your brokers access to the tools they need to be successful, including listings data, sales comparables, legal forms and contracts, and continuing education and networking events.

Appraisers

Value properties faster and appraise them more accurately with our comprehensive sales comparables, historical lease data, and building data that includes owner info, tenant data and demographics.

Affiliate CRE Organizations

Market your company, products, and services on our public and member websites. Our network includes brokers, appraisers, attorneys, lenders/mortgage, developers, title companies, and more!

Data You Can Trust

For over 45 years, our members know that we honor our word, maintain the highest standards of accuracy with our data, and care deeply about their success and the future of our industry. So while our tools may change to meet the evolving needs of the commercial real estate industry, from continuing education and legal documents, to behind-the-scenes advocacy at the state capitol and support of local chapters of related professional organizations — we will always serve above expectations in order to honor the trust we've earned from our members and our industry.

View MembershipsCBA at a Glance

4,400+

Broker and Affiliate Members and Growing

125,000+

Researched Commercial Property Records in Washington & Idaho

15,500+

Active Listings in Washington and Idaho

34,000+

Sale comparable records (CBAcmas) gathered over 20 years in King, Pierce, Snohomish, Thurston, Kitsap, & Spokane counties