CBA SALES OVERVIEW &

FULL RESEARCH REPORT

Commercial Property Sales Spike 63% in the 3rd Quarter of 2025, led by the Multifamily Asset Class

Commercial Brokers Association

Q3 2025 Sales Analysis Report

CBA's Commercial Market Analysis (CMA) Sales Report analyzes yearly and quarterly economic and commercial real estate sales activity and trends at the market and sub-market levels. Our quarterly report provides a detailed look into Washington’s commercial property sales market.

Key Q3 Highlights

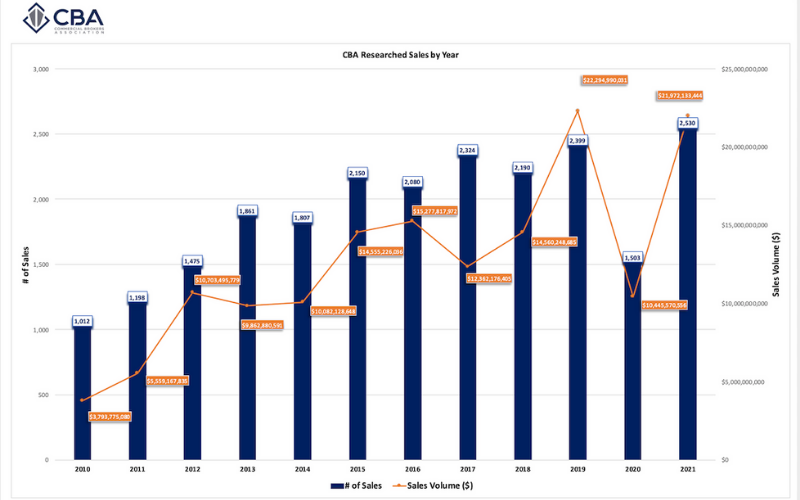

- The overall commercial property sales market in Washington entered the recovery phase in the 3rd Quarter, with the highest quarterly sales volume since mid-2022. Year to date- Sales volume is up 50% and the number of sales is up 11% compared to the same period in 2024.

- Q3-2025 marked the highest quarterly sales volume since Q2-2022 and highest number of sales since Q3-2022.

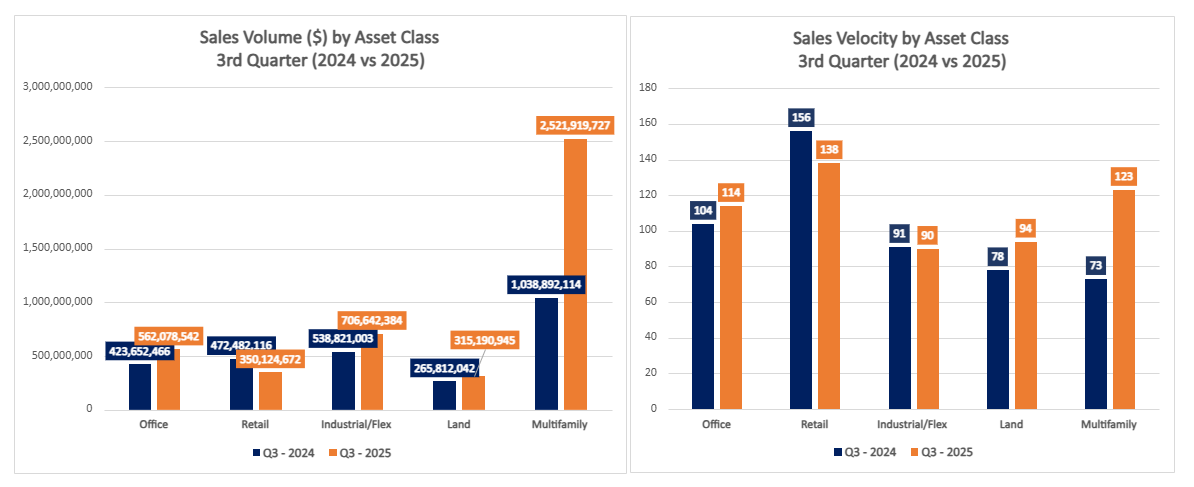

- The Multifamily segment of the market is in growth mode and continues to lead the pack, with roughly 57% of the Q3 sales volume but only 22% of the number of transactions. For the quarter, sales volume was up 143% from the prior quarter.

- Of the 5 major asset classes, 4 saw quarterly sales volume growth, which is broader based than what has been witnessed in the past few years. To spotlight the asset classes other than multifamily:

- Office: For the first time since mid-2022, Office exceeded the half billion-dollar market, with $560 million in volume

- Industrial: Up 31,1% in 3Q, Industrial sales volume has grown in 6 of the last 7 quarters, and saw its highest volume since the end of 2022

- Retail: Feeling downward pressure since the end of 2024, Retail sales volume has drifted downward during 2023, with Q3 sales volume down 26% and overall transactions down 11%

- Land: This quarter marked the 3rd consecutive increase in sales volume for Land, and for the quarter with transaction counts up 20% and sales volume up 18.6%

The quarters’ seven notable sales (over $100m) and largest transactions started showing more diversity outside of the Multifamily class this quarter, with 2 Industrial and 1 Office transaction:

- Woodinville Corporate Ctr (Ind/Flex, Woodinville) - $233m

- One Esterra Park (Office, Redmond) - $225m

- The Villas at Beardslee (MF, Bothell) - $177m

- The Hemlock (Multifamily, Seattle) - $124m

- 8995 Polaris Ln NE (Ind/Flex, Lacey) - $116m

- Liza Eastlake (Multifamily, Seattle) - $107m

- Arrive Magnolia (Multifamily, Seattle) - $106.5m

Looking ahead for the rest of 2025, CBA anticipates another strong quarter of commercial property sales, likely exceeding Q3 volumes, with at least $5 to $6 billion in quarterly sales. These levels would put the overall market at nearly $16 billion for the year, which would exceed market conditions from 2016, and would rank 2025 as the 4th highest sales volume year since 2012.

Asset Class Q3 Sales Volume Rankings (2025 vs 2024)

1. Multifamily ($2.5b) - up 143% | Multifamily ($1.04b)

2. Industrial/Flex ($707m) - up 31% | Industrial/Flex ($539m)

3. Office ($562m) – up 33% | Retail ($472m)

4. Retail ($350m) - down 26% | Office ($424m)

5. Land ($315m) – up 19% | Land ($266m)

Asset Class Q3 Trends (2025 vs. 2024)

Asset Class | Number of Sales | Sales Volume

Office | +10% | +33%

Retail | -12% | -26%

Industrial/Flex | -1% | +31%

Land | +21% | +19%

Multifamily | +69% | +143%

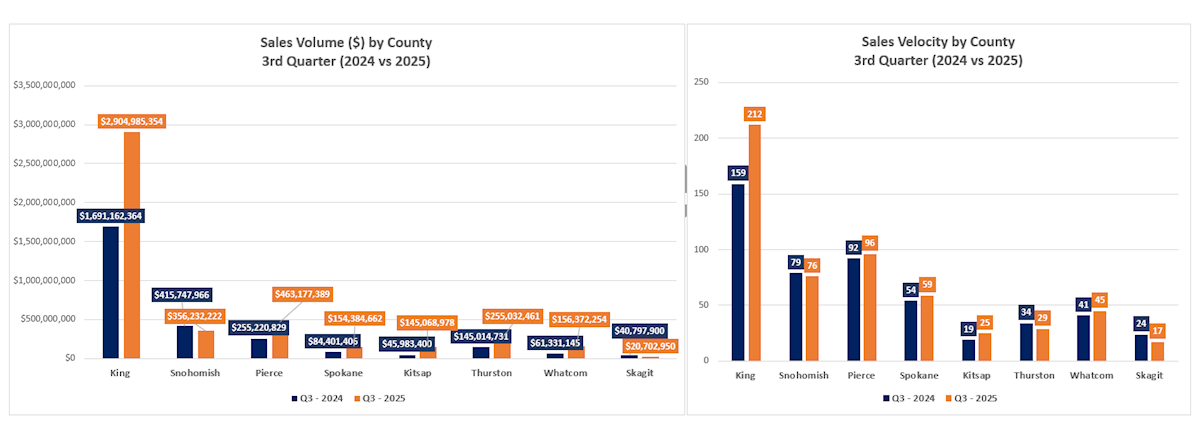

County Q3 Trends (2025 vs. 2024)

County | Number of Sales | Sales Volume

King | +33% | +72%

Snohomish | -14% | -14%

Pierce | +4% | +82%

Spokane | +9% | +83%

Kitsap | +32% | +216%

Thurston | -15% | +76%

Whatcom | +10% | +155%

Skagit | -29% | -49%

DOWNLOADABLE REPORTS

CBA researches office, retail, industrial, multifamily (5+ units), and land sales, $250,000 or more, in King, Kitsap, Pierce, Skagit, Snohomish, Spokane, Thurston, and Whatcom counties. The raw data in our reports are pulled directly from the CBAcma database.

For questions about the report, please contact Binh Truong, VP of Market Data and Business Development, at binh@commercialmls.com or 425-952-2727.

ARCHIVED CBA SALES REPORTS

Reference previously archived CBA Sales Reports here: